Recent stock values of Novo Nordisk, the multinational pharmaceutical company that markets Ozempic as an obesity cure for obese Americans, have surpassed Tesla.

Reuters:

Novo Nordisk’s (NOVOb.CO), maker of popular weight loss drug Wegovy, announced on Thursday positive results from an early clinical trial for a new drug that is highly anticipated.

The shares of Novo Nordisk rose more than 8%, reaching record highs. It climbed to 12th place in the global rankings, up from 14th, after the company informed investors that a Phase I study of an experimental drug called Amycretin, which is a pill, showed that participants lost 13.1% of their weight within 12 weeks.

We can expect the stock price to rise even more once the industry, via its “nonprofits” front groups, is successful in appropriating taxpayer money to subsidize Ozempic to all the millions of obese Americans on Medicare.

Wall St. is bullish about Ozempic being prescribed at scale to boost U.S. Gross Domestic Product.

Reuters:

Goldman Sachs estimates that the widespread use of powerful weight-loss medications in the United States will boost the gross domestic product (GDP) by 1% over the next few years, as fewer obesity-related complications may boost the workplace’s efficiency.

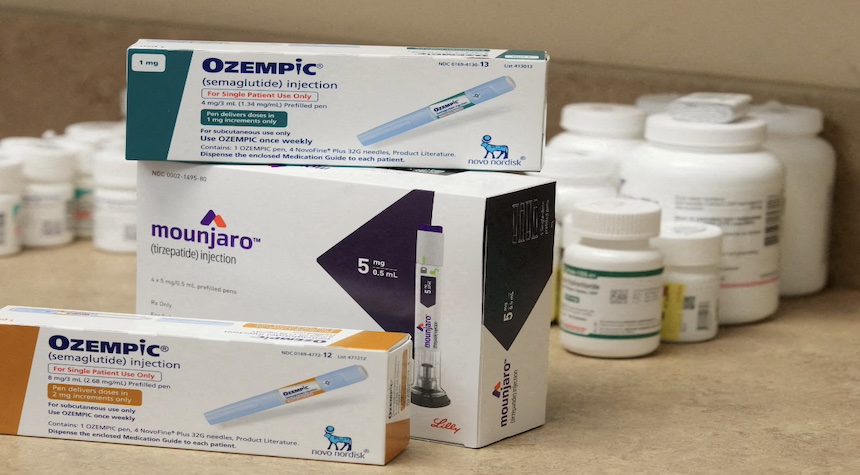

Analysts have predicted that the weight-loss drug market could reach $100 billion per year by the end of the decade. The leaders in the race are Novo Nordisk’s (NOVOb.CO) and Eli Lilly’s (LLY.N) Mounjaro.

Clinical trials could lead to the introduction of more GLP-1 agonists. Goldman Sachs stated on Thursday that the use of GLP-1s may increase from 10 to 70 million consumers by 2028.

Goldman economists wrote in a report that if GLP-1 use increases this much and leads to lower obesity rates, there could be significant spillovers into the wider economy.

“Academic research shows that obese people are less likely to be employed and less productive at work.”

Notably, the relative advantages and disadvantages of an Ozempic lifelong prescription for real humans are not even mentioned.

Goldman Sachs has made it clear to its customers that they don’t care about the well-being of people.

Consumer Affairs:

Goldman Sachs recently questioned, in a report published for their biotech clients whether curing patients is good for the business.

In a report dated April 10, the analysts of the company asked if curing patients was a viable business model. The report focused on promising research in the field of the human genome. CNBC obtained the Goldman Sachs report which does not directly answer this uncomfortable question.

Gilead Sciences, a pharmaceutical company, is a cautionary example. In 2015, the company launched a treatment that cured over 90 percent of hepatitis C patients. Goldman Sachs reports that sales of this treatment have dropped dramatically in the years following.

Goldman Sachs analyst Salveen R. wrote that such treatments offer a different outlook in terms of recurring revenue than chronic therapies.

“While this proposition is of great value to patients and society as a whole, it may pose a challenge to developers of genome medicine who are looking for sustaining cash flow,” he said.