According to investigative journaling by Newsmax Glenn Greenwald, House Speaker Nancy Pelosi has made millions of dollars in the stock market on companies she regulates, with a net increase from $41 million to $115 million. Over the last two years, she has made more than $33 million and done almost 75% of the trading in Big Tech. This makes Pelosi the sixth wealthiest member of Congress.

As pointed out in the report, five of the most-traded stocks by the Pelosi’s are the five Big Tech giants that would be most affected by pending legislation in the House. Pelosi has also been accused of having at least one private conversation with Apple CEO Tim Cook. She claimed that the conversation was about Cook’s concerns on the bill when she was making millions of dollars and helping him make changes to avoid harming his business.

Critics argued that this was a conflict of interest since the buying and selling in Apple alone accounts for 17.7% of Pelosi’s overall trading volume.

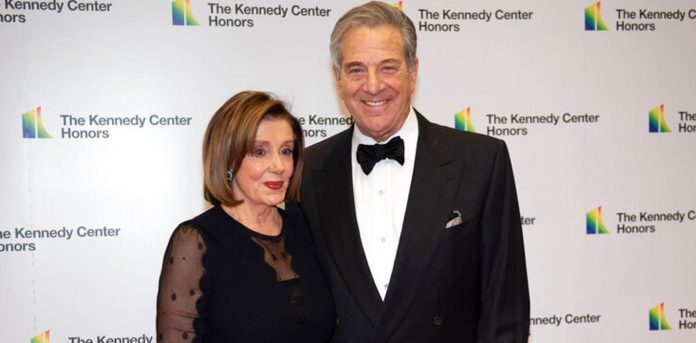

It was also reported that Pelosi and her husband have made some profitable investments in close proximity to happenings in Congress. Paul Pelosi, the House Speaker’s husband, exercised $1.95 million worth of Microsoft call options less than a few weeks before they secured a $22 billion contract to supply U.S Army combat troops with reality headsets.

Paul also purchased up to $1 million of Tesla stocks at the beginning of the year right before the Biden Administration announced its plans to shift away from traditional automobiles and towards electric vehicles. Paul also bought “highly risky” options in Google, Apple, and other tech companies in February 2020, just before the coronavirus pandemic. He held onto them as they plummeted in value and later sold them at a massive profit.

While the House Speaker has denied any involvement or knowledge of her husband’s stock trading, it’s clear how politicians become multimillionaires on government salaries after serving a couple of terms.

Even Rep. Alexandria Ocasio-Cortez has tried to call out Congress members and insider stock trading. She previously demanded the resignation of Kelly Loeffler and her husband’s COVID-related stock trading but hasn’t said anything about how this might apply to the House Speaker and her husband.

“Members of Congress should not be allowed to own individual stock. We are here to serve the public, not to profiteer. It’s shocking that it’s even been allowed up to this point,” AOC tweeted.

The nature and reality of their leadership positions allow them to work with larger companies and craft bills with non-public information along the way. The Pelosi’s know the outcome way before the public, but the question is whether or not it is illegal to trade based on insider information.

The report points out that the Pelosi’s are trading stock “most heavily” in the exact companies whose future is shaped by the bills they are negotiating through Congress. They aren’t voting out of personal belief, but whatever gets the most money in their pockets.

“Can even the hardest-core Democratic partisan loyalist justify this blatant conflict of interest and self-dealing?” The article asks.

It goes on to say that Pelosi’s wildly successful trading of stocks has been going on since 2004 in which she has had company influence and non-public knowledge. It’s fine to have your personal wealth triple over the years but the issue is about how that money was made.